- Ornaments0

- test-导入1

- 测试排序

- 家具用品11

- 宠物用品

- 家具用品3

- 家具用品2

- 玩具

- 装饰品

- 电子用品

- 家具用品

- 健身器材123

- 运动器材

- 健身器材

- Leisure and fitness equipment

- Finance and Insurance Industry

- Direct material supplier

- Lifestyle related topics

- Business use

- custom class

- qianqian-test16

- qianqian-test151as

- 产品分类8

- 产品分类7

- 产品分类6

- 产品分类5

- 产品分类1

- Auto Parts-test

- test 千千 With her love, I feel like a fish swimming happily in a beautiful sea.

- Industrial Hose

- filter paper

- tricycle

- Pet toys

- 颜色

- Food Rubber

- No picture classification

- Composite Rubbe

- Composite Rubber Hose2

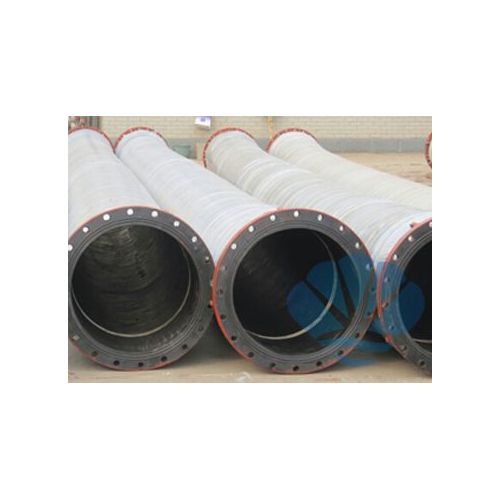

- Large Diameter

- Hydraulic Hose

Home sales case1

The U.S. housing market has seen a surge in sales for the third consecutive month in June with a 20.7% increase from May, according to the National Association of Realtors. This unprecedented rise in home sales has been attributed to a variety of factors, including near-record-low mortgage rates, competition for affordable houses, and a desire for more living space due to the COVID-19 pandemic.

The pandemic has undoubtedly caused a significant impact on the real estate industry as people are seeking bigger homes that can accommodate their remote work and learning needs. Additionally, with mortgage rates hovering at historic lows, more people are drawn to take advantage of the cheap borrowing, making it a perfect time to purchase a property.

111111

Regionally, the hotspots with the most significant increases in home sales are the Northeast and the West, which posted rises of 44.4% and 30.9%, respectively, from May’s figures. Home sales in the Midwest rose by 11.1%, while those in the South increased by 11.8%. These stats indicate that homebuyers in urban areas, coastal communities, and vacation destinations are leading the growth trend.

However, experts predict that the market could slow down in the coming months due to economic uncertainty and the potential resurgence of the virus. As per predictions, job losses and financial distress due to the pandemic could impact the demand for homes, inversely affecting the growth trajectory of the housing market.

While there’s been a surge in home sales, the supply side hasn’t been able to meet the skyrocketing demand, causing a shortfall in available homes for purchase. This has led to a rise in the housing prices to exorbitant highs, making it harder for first-time buyers to enter the market. The increasing cost of homes, along with stricter bank lending policies, could potentially impact the number of people that can afford to purchase a home, reducing demand and consequently, leading to slower growth.

In conclusion, while we have seen exponential growth in the US housing market, there is still uncertainty regarding its continuation in the coming months. Factors such as job losses, financial distress, and mortgage policies could impact demand, and a resurgence of the virus could also lead to slowdowns. However, if the current trend continues, the US real estate sector could be a strong pillar for the country's economic recovery.

- previous None

- next 每月案例发布测试(11.21发布)12.22添加啊

-

自定义客服1: 7890988

-

自定义客服2: 6789088

-

自定义客服3: 7890988

-

自定义客服4: 6789088